Building wealth isn’t just about making money—it’s about managing it wisely and growing it strategically. Smart investing allows you to put your money to work, helping you achieve financial freedom and long-term security.

1. Understanding the Basics of Investing

Investing means using your money to buy assets that can increase in value or generate income over time. Common investment vehicles include stocks, bonds, real estate, and mutual funds. The key is balancing risk and reward based on your goals and time horizon.

2. Setting Clear Investment Goals

Before investing, define what you’re working toward—whether it’s retirement, buying a home, or building passive income. Clear goals shape your strategy and help you choose the right mix of investments for your needs.

3. The Power of Compound Interest

Compound interest is one of the most powerful forces in wealth building. By reinvesting earnings, your investments grow exponentially over time. Starting early and staying consistent maximizes this compounding effect.

4. Diversifying Your Portfolio

A diverse portfolio protects you from major losses. Spread your investments across various sectors and asset types so that if one underperforms, others can offset the loss.

5. Managing Risk Wisely

Every investment carries risk, but not all risks are equal. Understanding your risk tolerance helps you choose the right investments and avoid emotional decisions during market volatility.

6. The Importance of Regular Contributions

Consistency beats timing. Even small, regular investments can grow significantly over time. Automate your contributions to ensure you keep building wealth regardless of short-term market changes.

7. Avoiding Emotional Investing

Emotions often lead to poor investment decisions. Avoid chasing trends or panicking during downturns. Instead, stick to your strategy and focus on long-term growth.

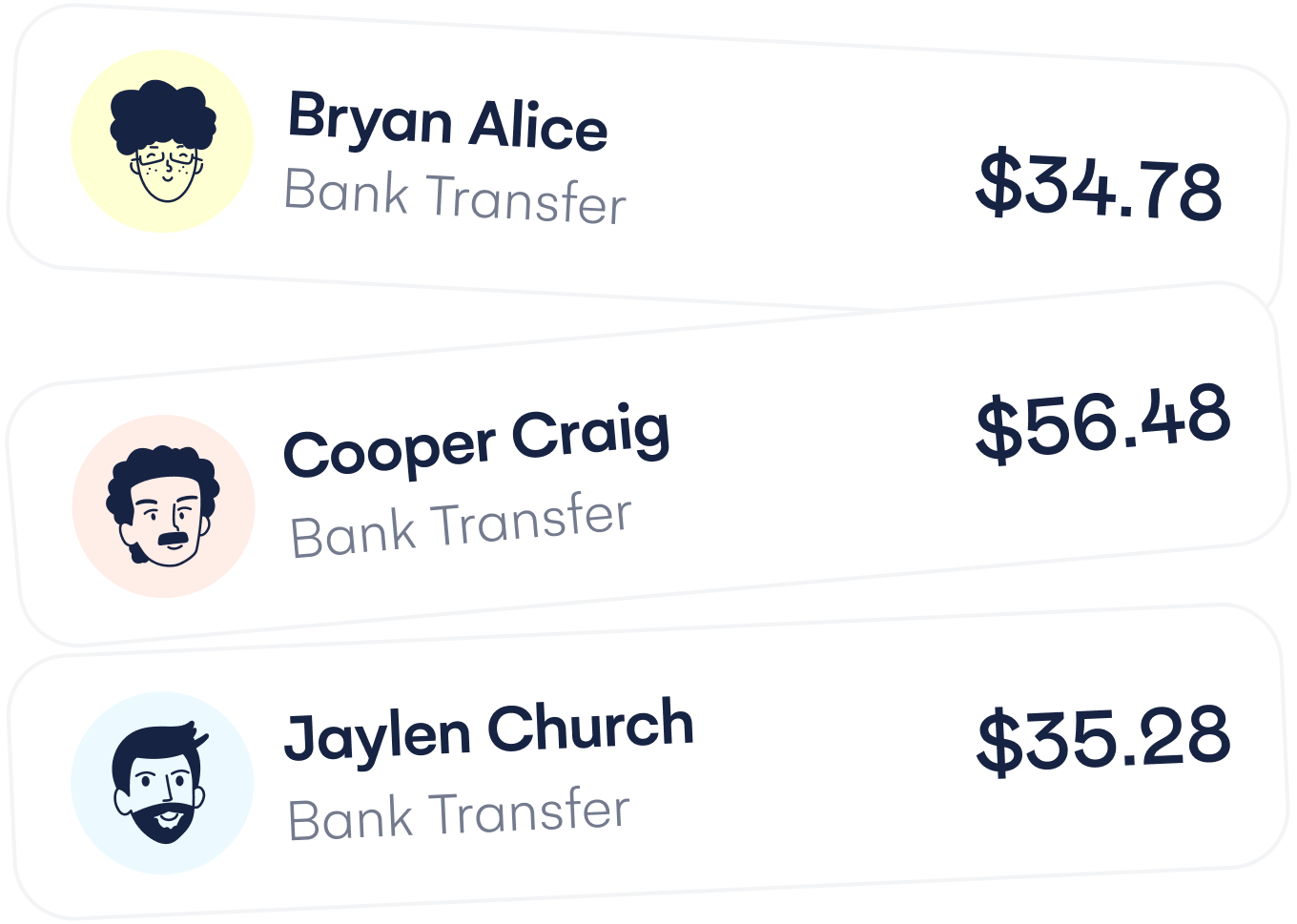

8. Using Technology for Smarter Investing

Modern apps and robo-advisors make investing accessible to everyone. They analyze market trends, manage portfolios automatically, and keep fees low—perfect for both beginners and busy professionals.

9. Learning from Market Trends

While no one can predict the market perfectly, studying patterns helps you make informed choices. Stay educated on global economic trends, interest rates, and industry changes.

10. Planning for the Long Term

Wealth building takes patience. Avoid get-rich-quick schemes and focus on sustainable growth. Reinvest profits and regularly review your portfolio to stay aligned with your goals.

Conclusion

Smart investing is about discipline, strategy, and time. With clear goals, diversified assets, and consistent contributions, you can confidently build wealth and secure a prosperous future.