The global financial landscape is evolving faster than ever, and at the heart of this transformation lies the rise of digital wallets. Once seen as a convenience, they are now a central component of the modern economy—changing how people shop, transfer money, and even think about financial security. Let’s explore how digital wallets are revolutionizing the way we handle money and why they represent the future of payments.

1. The Rise of a Cashless Society

The world is rapidly moving away from cash-based transactions. Consumers now prefer quick, contactless, and secure payment methods. Digital wallets like Apple Pay, Google Pay, and PayPal have become mainstream, offering seamless payments in stores and online. As technology advances, businesses are adapting to meet the growing demand for digital-first financial experiences.

2. What Exactly Is a Digital Wallet?

A digital wallet is a software-based system that securely stores users’ payment information, allowing transactions through smartphones, computers, or wearable devices. It eliminates the need to carry physical cards or cash. Beyond payments, many digital wallets now integrate loyalty programs, crypto assets, and identity verification features—becoming all-in-one financial tools.

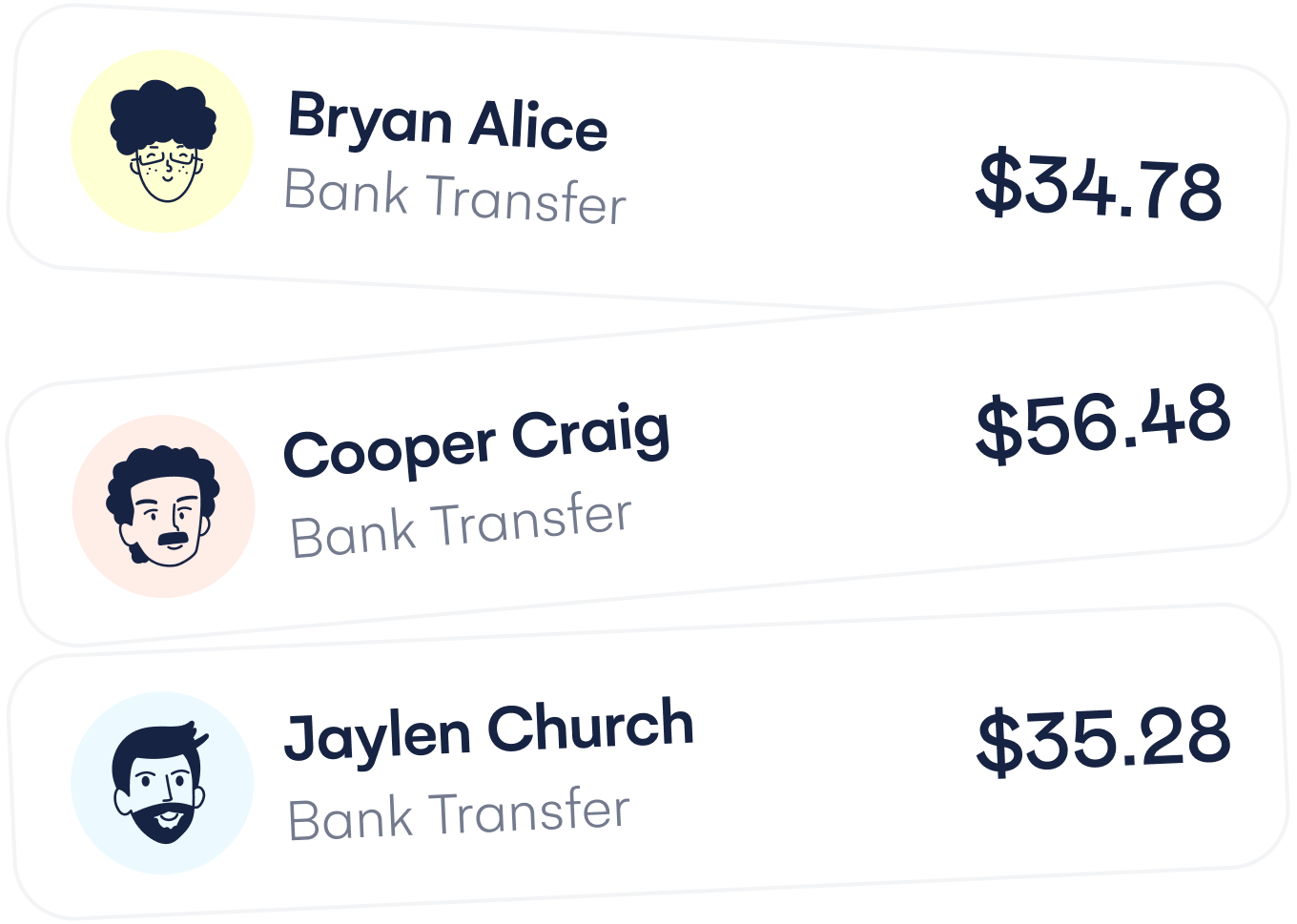

3. The Convenience Factor Driving Adoption

The biggest advantage of digital wallets is convenience. With just a tap or scan, users can complete transactions in seconds. Whether paying for groceries, sending money to friends, or booking travel, digital wallets simplify financial interactions, making them faster and more efficient than traditional methods.

4. Enhanced Security and Fraud Protection

Security is a key reason for their growing popularity. Digital wallets use encryption, tokenization, and biometric authentication (like fingerprints or facial recognition) to protect sensitive data. These advanced security layers reduce the risk of fraud and identity theft, giving consumers greater peace of mind when making transactions.

5. Integration with E-commerce and Mobile Apps

E-commerce platforms and mobile apps have fully embraced digital wallets as a preferred payment option. They not only simplify checkout but also boost sales conversion rates. With saved payment information and one-click checkout, customers enjoy a frictionless shopping experience, which in turn strengthens brand loyalty.

6. The Role of Digital Wallets in Financial Inclusion

Digital wallets are bridging financial gaps, especially in developing countries where traditional banking infrastructure is limited. Apps like M-Pesa and Paytm empower millions to access financial services for the first time—enabling savings, bill payments, and peer-to-peer transfers. This inclusion fosters economic growth and empowers underserved communities.

7. Cryptocurrency and Blockchain Integration

As cryptocurrencies gain traction, digital wallets are expanding to include crypto storage and transactions. Wallets such as Coinbase and MetaMask allow users to buy, store, and trade digital assets seamlessly. This convergence of traditional finance and blockchain technology signals a future where digital currencies play a major role in everyday payments.

8. The Impact on Businesses and Merchants

For businesses, adopting digital wallets isn’t just a trend—it’s a necessity. Merchants that accept digital payments benefit from faster transactions, reduced cash handling, and increased customer satisfaction. Moreover, digital wallets offer valuable consumer data insights, helping businesses tailor marketing and loyalty programs.

9. Emerging Technologies and Future Innovations

The next wave of payment innovation will be driven by technologies like artificial intelligence, 5G connectivity, and the Internet of Things (IoT). Smart devices—from cars to home assistants—are expected to integrate digital wallet functionality, allowing seamless, automated payments in everyday environments.

10. Challenges and the Road Ahead

Despite their benefits, digital wallets face challenges such as cybersecurity threats, regulatory hurdles, and limited interoperability between platforms. However, as global standards evolve and security strengthens, digital wallets will continue to dominate the payment ecosystem, redefining how individuals and businesses manage money.

Conclusion

Digital wallets are not just a technological innovation—they’re a financial revolution. By combining convenience, security, and inclusivity, they’re transforming how money moves in the digital age. As the world moves toward a fully cashless society, digital wallets will remain at the forefront of financial innovation, shaping the future of global commerce and everyday payments.