Financial technology, or “fintech,” has revolutionized how we save, spend, and invest. From mobile banking to cryptocurrency, fintech innovations are making finance faster, smarter, and more accessible than ever before.

1. Understanding Fintech

Fintech combines finance with technology to deliver smarter financial services. It includes everything from mobile apps to AI-driven investment platforms that simplify complex money management.

2. The Growth of Mobile Banking

Mobile banking apps have replaced long lines and paperwork. Today, users can check balances, transfer funds, and apply for loans—all from their phones.

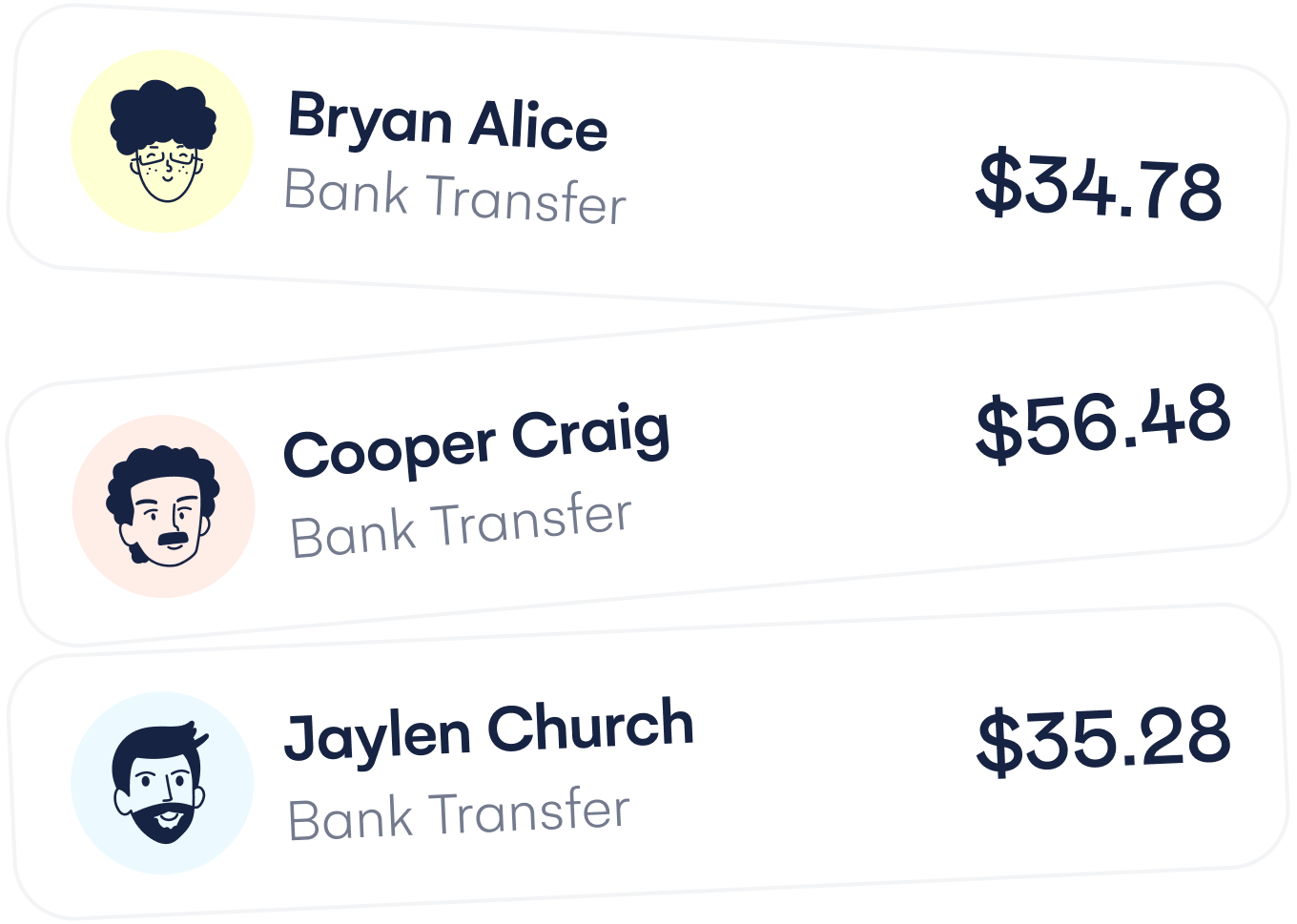

3. Payment Innovations and Digital Wallets

Digital wallets like Apple Pay, Google Pay, and PayPal have made cashless transactions effortless. They offer convenience, security, and integration with e-commerce platforms.

4. Peer-to-Peer (P2P) Lending Platforms

P2P lending allows borrowers and lenders to connect directly, bypassing traditional banks. It provides access to capital for small businesses and better returns for investors.

5. Cryptocurrency and Blockchain Technology

Blockchain has brought transparency and decentralization to finance. Cryptocurrencies like Bitcoin and Ethereum are reshaping how we think about money and global transactions.

6. Artificial Intelligence in Finance

AI powers everything from fraud detection to personalized investment recommendations. It enhances accuracy, efficiency, and user experience in financial services.

7. The Rise of Robo-Advisors

Robo-advisors automate investing by using algorithms to create and manage portfolios. They make investing affordable and accessible to people with limited financial knowledge.

8. Security and Data Protection

As fintech grows, cybersecurity becomes crucial. Encryption, biometric authentication, and blockchain ensure data safety and protect users from financial fraud.

9. Fintech for Financial Inclusion

Fintech bridges the gap for unbanked populations, especially in developing countries. Mobile money services provide access to banking, payments, and credit for millions.

10. The Future of Fintech

The future will see even greater integration between finance and technology—through AI-driven analytics, open banking, and decentralized finance (DeFi). Businesses that adapt to fintech innovations will thrive in the digital economy.

Conclusion

Fintech has forever changed how we interact with money. By combining technology, innovation, and accessibility, it empowers individuals and businesses alike—creating a smarter, more inclusive financial future.