Taking control of your finances starts with mastering the art of budgeting. A well-structured budget empowers you to make smarter decisions, eliminate debt, and build lasting financial security. Here’s a comprehensive guide with ten key principles to help you gain control of your money and your future.

1. Understand the Importance of Budgeting

Budgeting isn’t about restricting yourself—it’s about freedom. By knowing exactly where your money goes, you gain the power to make informed decisions and align your spending with your goals. Without a budget, it’s easy to overspend and lose track of your financial priorities.

2. Assess Your Current Financial Situation

Before creating a plan, you must know where you stand. Gather details about your income, expenses, debts, and savings. Reviewing your bank statements for the last three months can help identify patterns and highlight where your money is being wasted.

3. Set Clear and Realistic Financial Goals

Whether it’s paying off debt, buying a home, or saving for retirement, your budget should reflect your goals. Break them down into short-term (3–12 months), medium-term (1–5 years), and long-term (5+ years) objectives. This keeps you focused and motivated.

4. Track Your Income and Expenses

List every source of income and categorize all expenses—fixed (rent, utilities) and variable (food, entertainment). Use budgeting apps or spreadsheets to track spending habits. Regular tracking prevents overspending and highlights areas for improvement.

5. Create a Practical Budget Plan

Once you know your numbers, assign specific amounts to each category based on priority. A popular method is the 50/30/20 rule—50% for needs, 30% for wants, and 20% for savings or debt repayment. Adjust these percentages to match your lifestyle and goals.

6. Build an Emergency Fund

Unexpected expenses—like medical bills or car repairs—can derail your finances if you’re unprepared. Aim to save at least three to six months’ worth of living expenses in a separate account. This safety net provides stability and peace of mind.

7. Manage and Reduce Debt Wisely

Debt management is key to financial freedom. Start by listing all debts and prioritize repayment using either the avalanche method (highest interest first) or snowball method (smallest balance first). Avoid taking on new debt unless absolutely necessary.

8. Adjust and Review Your Budget Regularly

Your financial situation and priorities will change over time. Review your budget monthly to track progress and make adjustments. Small, consistent tweaks ensure your plan stays realistic and effective as your income or expenses fluctuate.

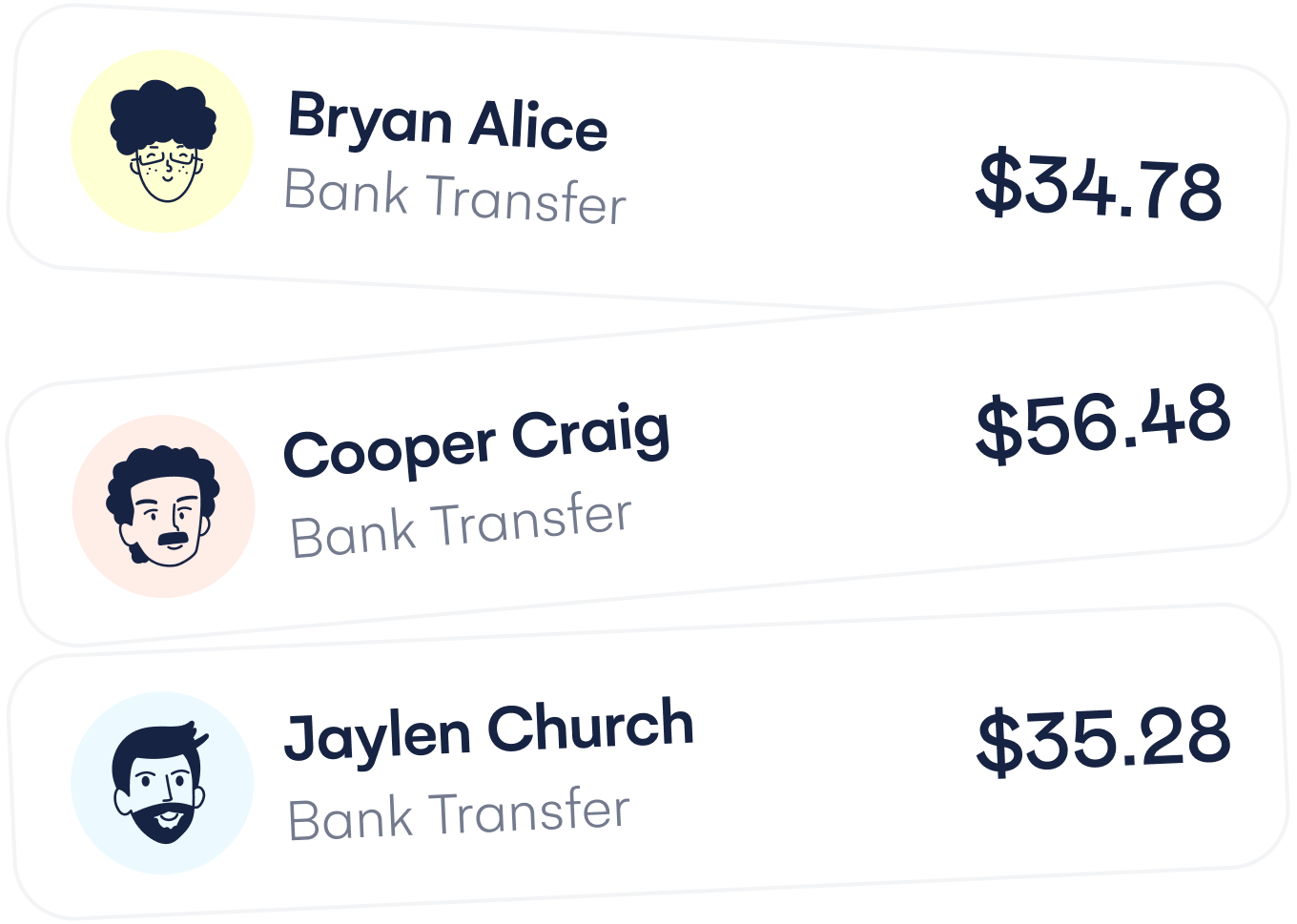

9. Use Technology to Simplify Budgeting

Leverage digital tools like budgeting apps, expense trackers, and automated savings transfers. These tools provide real-time insights and reminders, making it easier to stay disciplined and maintain financial awareness.

10. Stay Consistent and Reward Yourself

Budgeting is a long-term habit, not a one-time task. Stay patient and committed, even if progress feels slow. Celebrate small victories—like hitting a savings milestone or paying off a credit card—to stay motivated and enjoy the journey toward financial control.