Managing business finances efficiently requires more than spreadsheets and manual calculations. Modern financial tools automate repetitive tasks, enhance accuracy, and provide insights that drive smarter decisions. Here are ten key subheadings to explore how businesses can optimize their finances using the best tools available today.

1. The Importance of Financial Tools in Modern Business

In a fast-paced digital economy, relying on outdated methods can hinder business growth. Financial tools help automate accounting, track cash flow, and ensure financial transparency—critical components for both startups and established enterprises.

2. Streamlining Operations with Accounting Software

Accounting software like QuickBooks, Xero, and FreshBooks are game-changers. They simplify bookkeeping, automate invoicing, and offer real-time financial tracking. These platforms ensure accurate financial records and compliance with tax regulations while saving valuable time.

3. Enhancing Expense Tracking and Control

Expense management tools such as Expensify or Zoho Expense allow businesses to digitize receipts, categorize expenses, and manage reimbursements efficiently. This reduces human error, prevents overspending, and provides detailed spending insights for better budgeting.

4. Managing Cash Flow Effectively

Cash flow management software like Float or Pulse enables businesses to monitor financial health proactively. These tools forecast cash inflows and outflows, highlight potential shortages, and allow companies to make strategic decisions before problems arise.

5. Simplifying Payroll Processing

Payroll and HR tools like Gusto or ADP automate salary calculations, deductions, and compliance filings. They minimize errors, ensure timely payments, and improve employee satisfaction—all while keeping records organized for audits or reviews.

6. Improving Financial Forecasting and Planning

Tools such as PlanGuru and LivePlan help businesses create accurate financial forecasts and budgets. They analyze trends, simulate different financial scenarios, and provide clear roadmaps to help companies meet their goals.

7. Leveraging Financial Analytics for Better Decisions

Analytics tools like Fathom, Tableau, or Power BI turn raw data into actionable insights. These platforms provide real-time dashboards and performance indicators, allowing leaders to make informed and strategic financial decisions quickly.

8. Ensuring Data Security and Compliance

Financial data is highly sensitive, and security is non-negotiable. Modern financial tools come with encryption, multi-factor authentication, and audit trails to safeguard information and ensure compliance with financial regulations.

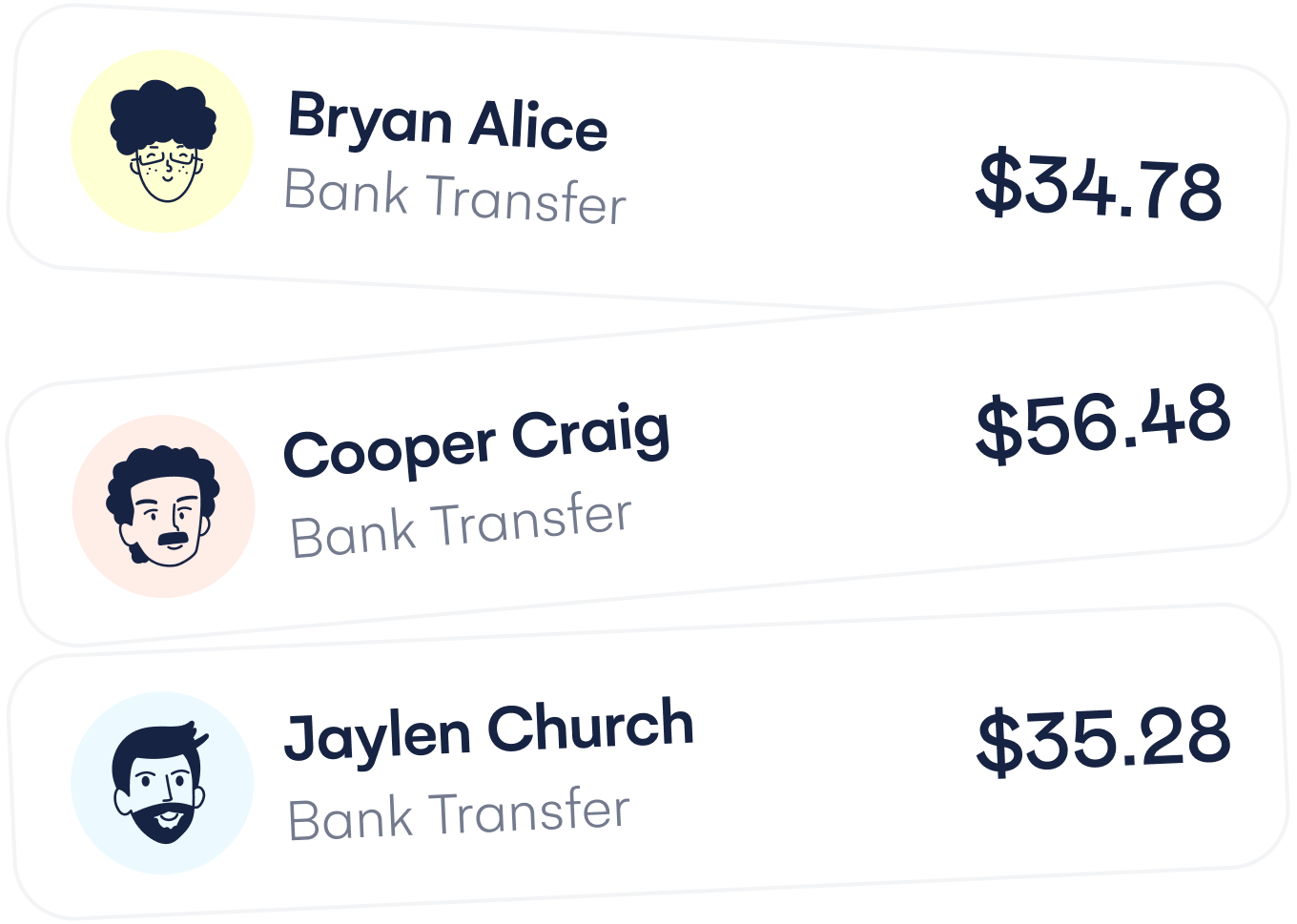

9. Integrating Systems for Seamless Workflow

Integration between accounting, CRM, and payment systems improves efficiency and reduces duplication. Businesses that connect tools like QuickBooks with platforms like Shopify or Stripe benefit from synchronized financial data and smoother operations.

10. Choosing the Right Financial Tools for Your Business

No single tool fits every business. Consider your company’s size, industry, and growth goals when selecting software. Focus on scalability, ease of use, and integration capabilities to ensure the tools you choose evolve with your business needs.

Conclusion

Financial tools are the backbone of smart business management. By embracing technology that automates and optimizes financial processes, businesses can save time, reduce errors, and gain insights that drive sustainable growth. The key is to choose the right mix of tools that align with your goals and set your business up for long-term financial success.