Financial wellness goes beyond having money—it’s about feeling secure and in control of your financial decisions. Developing strong money habits can help you live comfortably today while preparing for tomorrow.

1. Defining Financial Wellness

Financial wellness means stability and peace of mind. It’s knowing your bills are paid, you have savings for emergencies, and you’re on track to reach future goals.

2. Creating a Realistic Budget

A realistic budget helps you understand where your money goes and ensures your spending aligns with your priorities. Track income, expenses, and savings to create balance.

3. Building an Emergency Fund

Unexpected expenses happen. An emergency fund covering three to six months of living costs ensures you don’t rely on credit cards or loans when life surprises you.

4. Managing Debt Effectively

Not all debt is bad—but it must be managed. Focus on high-interest debts first, make consistent payments, and avoid unnecessary borrowing.

5. Practicing Mindful Spending

Before buying, ask: “Do I really need this?” Mindful spending helps prevent impulse purchases and encourages intentional financial choices.

6. Prioritizing Savings Goals

Whether saving for retirement, travel, or education, set specific goals. Automate savings transfers to make the process effortless and consistent.

7. Protecting Your Finances with Insurance

Insurance provides a safety net for you and your loved ones. Health, life, and property insurance protect your financial stability in case of emergencies.

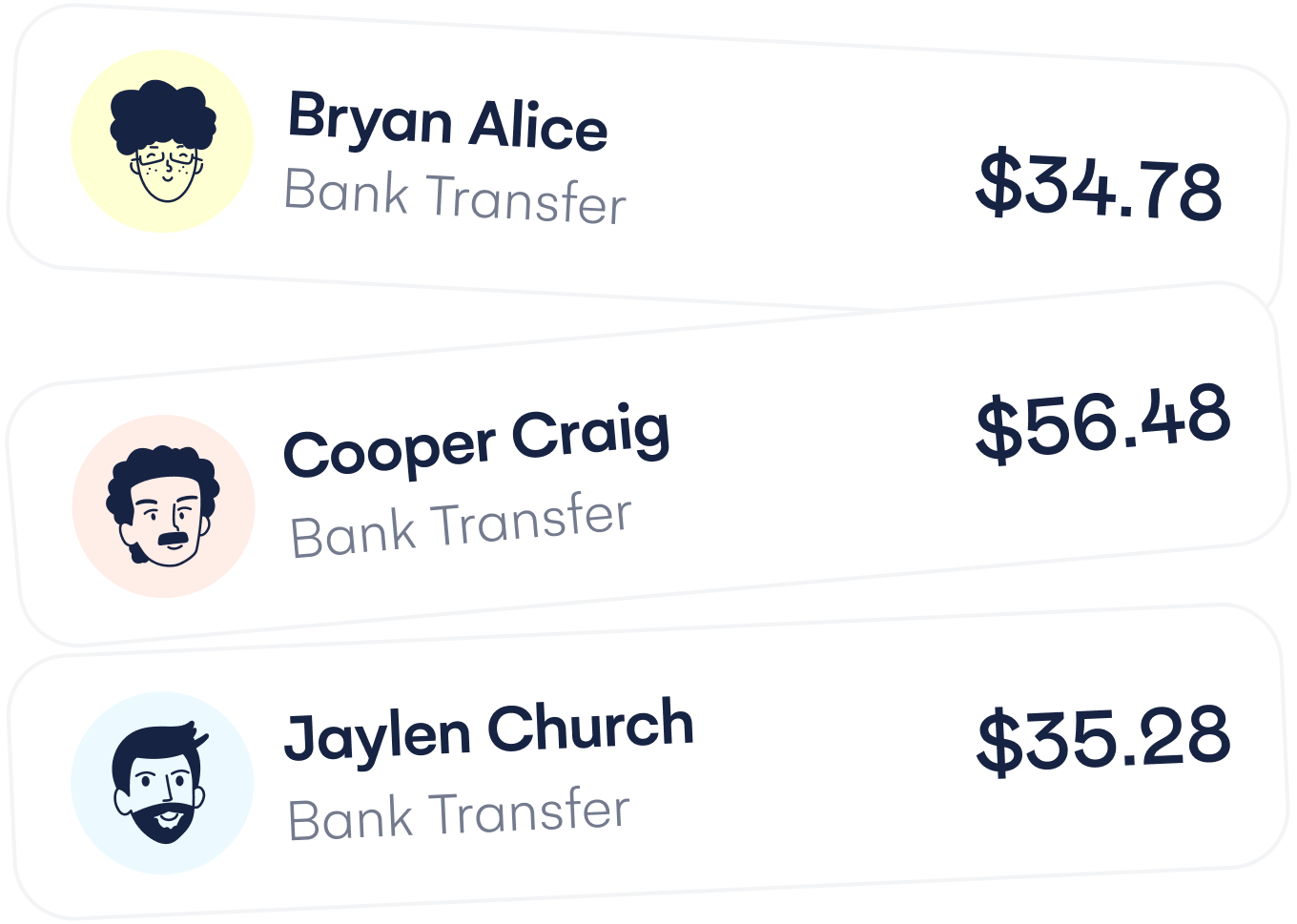

8. Tracking Financial Progress

Review your finances regularly. Monthly check-ins help identify problem areas, celebrate progress, and keep you motivated to stay on track.

9. Investing in Your Future

Once your basics are covered, start investing. Even small contributions to retirement or index funds today can lead to significant returns later.

10. Seeking Professional Advice When Needed

If managing finances feels overwhelming, consult a certified financial planner. Expert advice ensures you’re making the best decisions for your situation.

Conclusion

Financial wellness isn’t about wealth—it’s about control, clarity, and confidence. By adopting good habits, staying organized, and planning ahead, you can live a financially stress-free and fulfilling life.